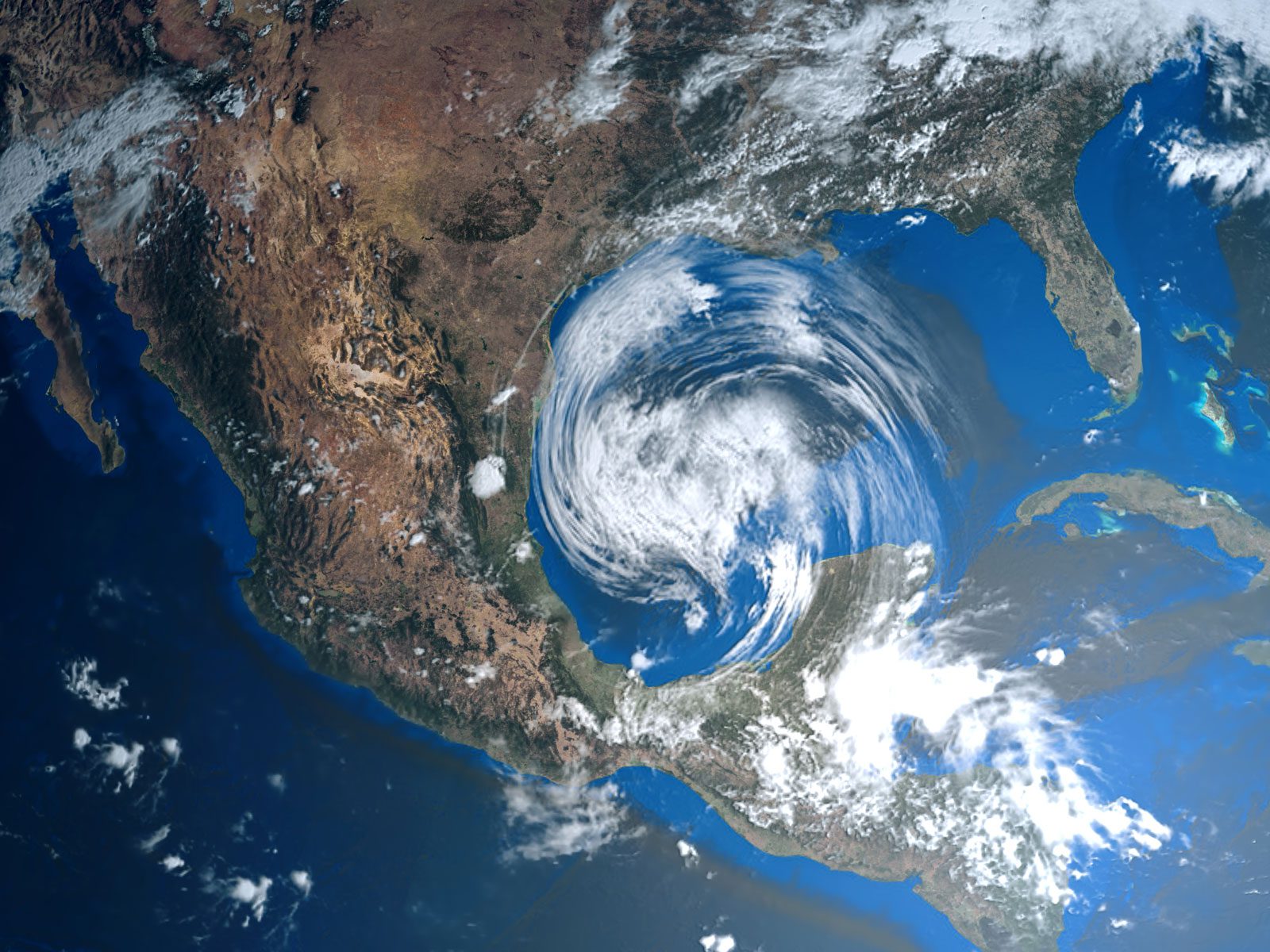

Being prepared for a hurricane requires constant updates and evolving actions. A true state of preparedness means you are ready for something, but more importantly, you are aware of the ever-changing nature of, well…Nature.

Anyone who lives or works near coastal waters, plans to visit them or has family and friends in those areas takes the time to become educated on hurricane awareness and preparation. A great online resource is The National Hurricane Center’s website. There you can download the Tropical Cyclone Preparedness Guide(PDF 6.2MB) that not only explains what a hurricane is in great detail, but gives you a starting point on how to recognize and prepare for the disaster before it strikes.

Those who reside further inland may ask “why would I ever need to prepare for or even be concerned about a hurricane?” In 2008, Hurricane Ike caused wind and flood damage in Ohio, Kentucky, Indiana, Illinois and Pennsylvania, to name just a few states. Remnants of Ike even caused damage in Canada. So much for hurricanes only being a concern for the coastal states!

Keeping track of hurricanes as they move inland is just as important as tracking hurricanes on the coasts. The NOAA’s National Weather Service can keep you apprised of what might be coming your way. Know the difference between a hurricane watch and a hurricane warning.

Here are some things you as a property owner can do before a catastrophe hits that will help you in the event you need to file an insurance claim for property damage. Keep in mind, this is certainly not all-inclusive, and true preparation will be specific to the event and the property involved.

- Understand the coverage provided in your policy. No one should be surprised that things like “flood” and “earth movement” may be limited or excluded under some insurance policies. If something isn’t clear to you, contact your agent and get an explanation of exactly what your policy will provide for you.

- Educate yourself on how to best protect your property for the area where you reside and the disasters that may affect you.

- Do you need to store plywood that has been cut to protect your windows and glass doors?

- What is the safest part of your home or office should high winds blow through or a tornado touch down?

- Do you have large trees next to your building that could be pruned or cut back to make them more stable against high winds?

- Investing in a generator and having extra fuel on hand during those months where storms can be severe can save your basement from sump failure and flooding or your freezers from thawing and food spoilage. Refer to our tornado preparedness blog for more information about assembling an emergency kit for your home.

- Organize and store your most important documents off-site (retaining copies for reference as needed) or in a fire- and flood-rated safe. This should include that home Inventory you’ve read about here before as well as your property insurance policy. Find our two-part series about home inventories here: Part One; Part Two.

- Store your local agent’s contact number and your carrier’s direct contact number in your phone and also keep a written copy. Local agencies can be affected by loss of power and storm damage and may not be able to provide immediate assistance in reporting your claim. Chances are, your carrier will. If you have a policy with The Cincinnati Insurance Companies, you may report most claims by contacting your local professional independent agency or by contacting us directly.